ARTICLES

The (Many) Benefits of Saving in PRS

Husaini Hussin, CEO of Private Pension Administrator Malaysia (PPA)

An overwhelming 70% of people who took a survey in March by Private Pension Administrator Malaysia (PPA) said they wished they are saving more for their retirement.

The survey, developed as part of PPA’s continuous initiative to make Private Retirement Schemes (PRS) a strong retirement savings pillar, also revealed that lower fees, higher monthly income and better fund performance are the top three considering factors before saving more in PRS.

“It is encouraging to know that so many want to save more,” said Husaini Hussin, CEO of PPA, the central administrator for PRS. “To this end, I wish to highlight the benefits of saving in PRS here.”

Affordable and Low Fees

Saving for retirement is affordable as RM100 is all you need for your initial contribution. Sales charges and management fees of PRS funds are also lower on average compared to unit trusts.

Additionally, if you use PRS Online Enrolment, 0% sales charge is offered by participating PRS Providers for enrolees aged 30 and below. As an added bonus, those who enrol online from August 1st onwards will stand a chance to receive PRS Treats from our contest. Look out for it!

Long Term Growth

The important thing is to start saving now. When your income increases, you can raise your contributions accordingly to the recommended 10% of your monthly salary.

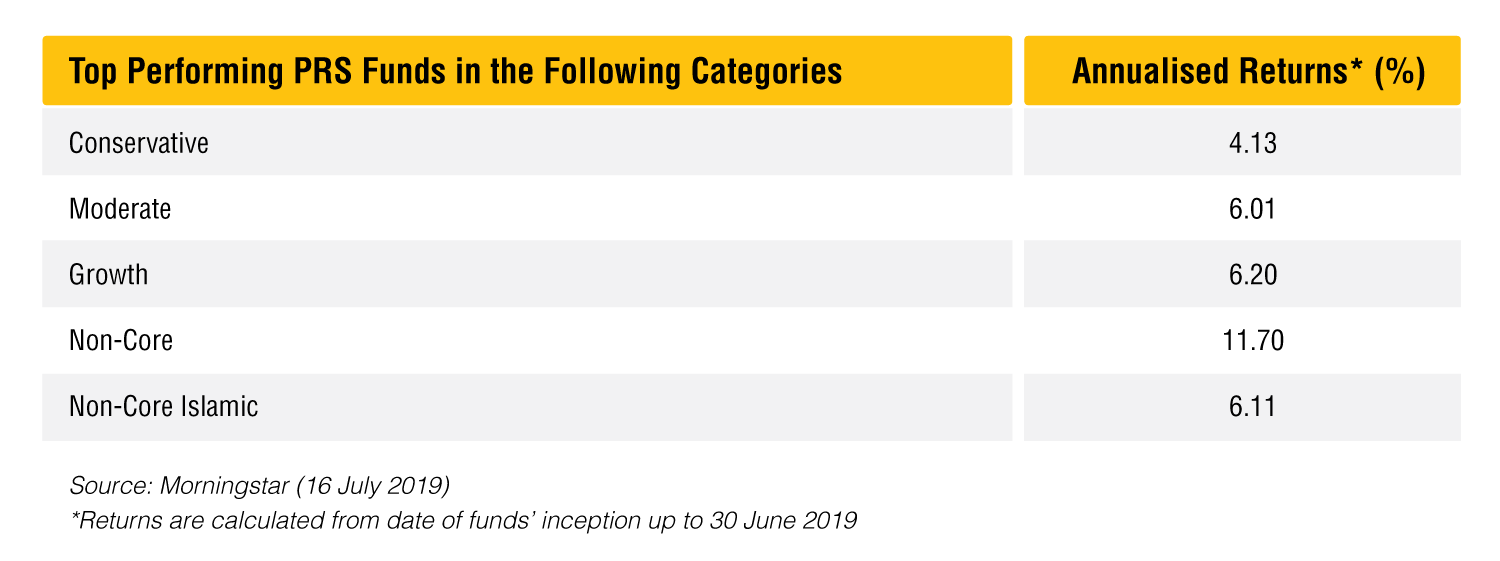

Setting aside a fixed sum monthly allows you to ride the wave of market volatility and not be overly focussed on short-term fund performance. This strategy gains you more units when prices are low and you could benefit from positive returns over the long term (see table below).

Fifty nine percent of survey respondents put an online direct debit service at the top of their wish list to start saving on a monthly basis, which affirms PPA’s ambition to introduce this service next year.

Choice and Flexibility

With eight PRS Providers offering 55 Islamic and Conventional funds, there are no shortage of PRS funds to choose from. If you can’t decide, a unique feature of PRS allows you to go for the age-based default option, which aligns the suitable asset allocation to your age group.

Whether you self-select or pick the default option, you always have the flexibility of switching PRS funds within the same PRS Provider or transferring your money altogether to another PRS Provider.

Tax Relief

Contributions you make to your PRS account are eligible for a personal tax relief of up to RM3,000 annually. Your tax savings can be substantial depending on your tax brackets, giving you more reasons to boost your retirement savings.

With PRS Online, you can start saving for your retirement with just a few simple steps.

With PRS Online, you can start saving for your retirement with just a few simple steps.

PPA as the Central Administrator

In addition to providing one-stop account management, PPA also developed the PRS Online service so you can monitor your retirement savings and top up your PRS funds anytime, anywhere. Furthermore, you can make a nomination through PPA and name up to six beneficiaries.

After working hard for three to four decades, your retirement should be your reward. Get to enjoy everything you work for. Save in PRS.

Source: Private Pension Administrator Malaysia (PPA). PPA is the Central Administrator for the Private Retirement Schemes (PRS). This article first appeared in The Star on 23 July 2019.