ARTICLES

Preparing for Retirement through PRS

With an average life expectancy of about 75 years old and the current retirement age at 60 years old, Malaysians have to ensure their retirement savings is enough to sustain at least 15 years after they stopped earning an active income.

The retirement age in Malaysia is one of the lowest in the world. On one hand, it allows us to spend more time pursuing our passions beyond work, on the other hand, it has forced many among us to delay our retirement or find alternative means of income well into old age.

The idea that Malaysians do not have enough savings for a decent life after retirement is indeed a bitter pill to swallow, especially after having worked long and hard for most of our lives.

To address this predicament, the Private Retirement Schemes (PRS) was introduced in 2012 to build their retirement income by complementing the mandatory scheme.

Smart Investor speaks with Private Pension Administrator Malaysia (PPA) CEO Husaini Hussin about how PRS offer individuals a way to build another fund they can tap into when they retire.

Smart Investor: The total number of PRS members grew by 38% last year. What contributed to this impressive growth and do you expect such growth in coming years?

Husaini Hussin: We saw substantial growth among members in the 18-39 age group last year. One reason for this is the youth incentive, which has been a resounding success in encouraging young Malaysians to start saving for their retirement from an early age. The PRS tax relief is another contributing factor to this growth.

There is a higher awareness amongst working adults to save in PRS as their contributions can provide a personal tax relief of up to RM3,000 annually. Depending on their income bracket, the potential tax savings is as much as RM840, which can be reinvested to further grow their PRS retirement savings.

On the whole, 2018’s growth was the highest since PRS was established in 2012. This is especially significant given that PRS is a voluntary scheme. We want to continue this trajectory of growing in the 30% range.

PRS funds generally delivered lower average returns last year. Will 2019 likely see improved performance by PRS funds?

Last year was volatile for markets across the board due to a confluence of various global and external challenges. But, if you practice ringgit-cost-averaging by setting aside a fixed sum monthly, you can ride the wave of market volatility and not be overly affected by short-term fund performance.

This strategy gets you more units when prices are low and you benefit from potentially positive returns over the long term. In other words, market fluctuations in the short term works in your favour with ringgit-cost averaging.

Which are the best performing PRS funds and which categories are they in?

Each category of PRS funds are designed for PRS members with different risk profiles. Up to 30 June 2019, the top performing PRS fund produced an annualised return of 11.7%. So be sure to check how your PRS funds are performing from time to time. You always have the flexibility of switching PRS funds within the same PRS Provider or transferring your savings to another PRS Provider.

How does age and risk appetite determine which PRS fund one should choose to invest in?

A special feature of PRS which makes investing your savings for retirement easy is the age-based default option, which aligns the suitable asset allocation with your age group. Those who are below 40 years old will be allocated to a growth fund; 40-50 years old to a moderate fund; and 50 years old and above to a conservative fund. This option comes with an auto-glide path that automatically adjust and manage your risk exposure over time.

Alternatively, you may opt for self-selection, which requires you to actively choose core or non-core funds based on your risk appetite. Core fund are those in the categories of Growth, Moderate and Conservative, whereas non-core funds comprise of various asset classes such as REITS, bonds and equities, among others. Additionally, Shariah funds are also available in both core and non-core categories.

Can one be too old to save for retirement via PRS? Is there an ideal age to start contributing to PRS?

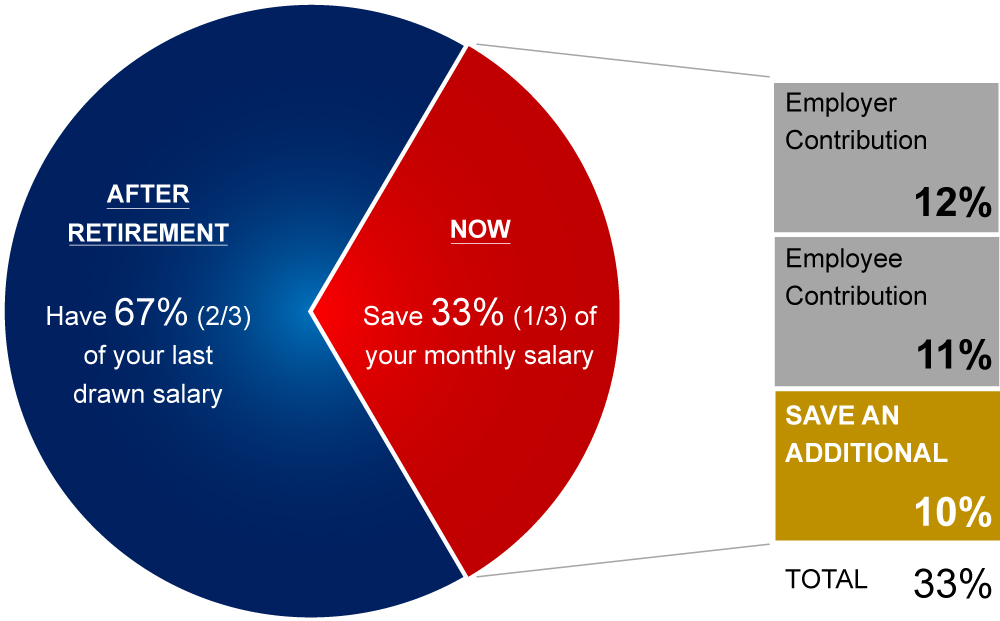

The ideal age to start saving for retirement is now. The earlier you start saving, the longer your time horizon is for your savings to benefit from compounding growth. You can start saving with as little as RM100 with PRS Online by PPA. When your income increases, you can raise your contributions accordingly to the recommended 10% of your monthly salary.

As an added bonus, we are currently running a PRS Online Enrolment Treats Contest with the theme ‘GO PRS, GET TREATS!’ From now until November 30, new and existing PRS Members stand to receive attractive PRS Treats. Visit PPA’s website for more information.

Source: Private Pension Administrator Malaysia (PPA). PPA is the Central Administrator for the Private Retirement Schemes (PRS). This article first appeared in Smart Investor on 1 September 2019.