NEWS

Private Retirement Schemes continues to see steady growth, NAV exceeds RM5 billion

Number of members crosses half a million milestone

PETALING JAYA (3 May 2021):

The Private Retirement Schemes (PRS) today has exceeded RM5 billion in total net asset value (NAV) with half a million Malaysians saving for the retirement. This momentous milestone was achieved as a result of the PRS industry’s steady growth since its inception, which represented an increase of 43% from that of RM3.5 billion as at 31 December 2019.

Securities Commission (SC) Chairman,

Datuk Syed Zaid Albar

Datuk Syed Zaid Albar said, “The continuing maturity of the PRS industry, as evidenced by this milestone, bodes well for Malaysians seeking additional avenues to accumulate retirement savings. The SC is committed to enhancing the PRS framework including expanding the breadth and depth of PRS offerings and its related services. This includes greater use of technology to widen accessibility of this voluntary scheme and increase its appeal to a younger generation of prospective members.”

PPA Chairman Datuk Zaiton Mohd Hassan added, “Reaching this landmark is a testament of the public’s confidence in PRS as a voluntary savings scheme for their retirement. This vote of confidence is not something PPA takes lightly, which is why we work hard every year in collaboration with PRS Providers to develop more value-added services such as PRS Online and the Nomination feature.”

The NAV growth of 43% from the end of 2019 was made possible by the resilient and strong performance of PRS funds, despite going through last year’s volatility and witnessing its fair share of market movements over the past nine years.

PPA Chairman,

Datuk Zaiton Mohd Hassan

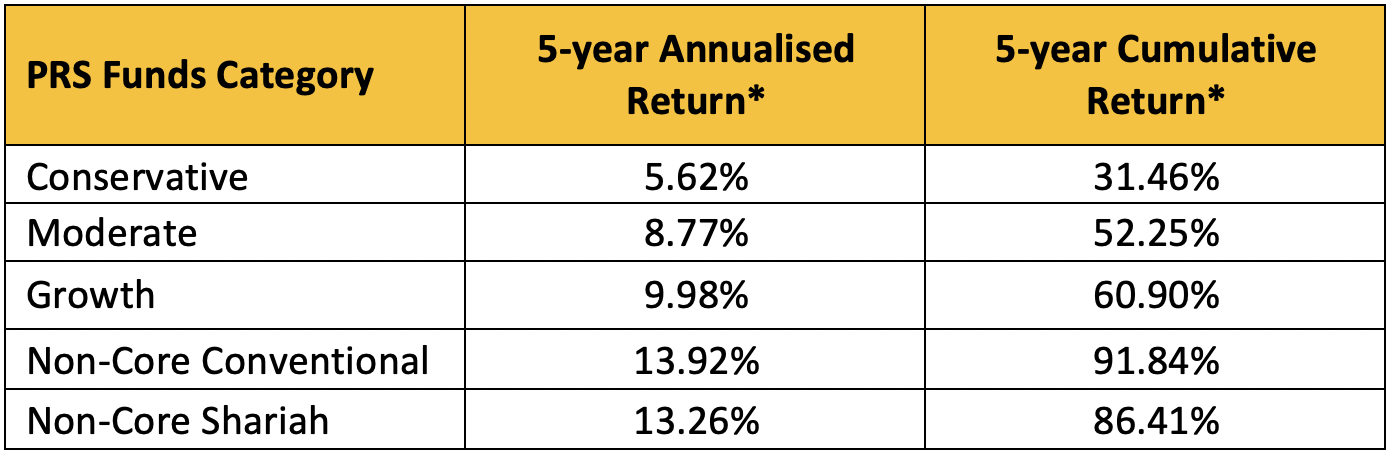

Below is a summary of PRS top fund performance according to categories:

*Return over a 5-year period up to 31 March 2021.

Source: Morningstar

To further spur the industry, PPA will continue to work closely with the SC, PRS Providers and its network of close to 25,000 PRS Consultants nationwide in its continuous drive to raise awareness about the importance of saving for retirement, especially among the youth. Currently, about 58% of PRS Members are aged 40 and below, which augurs well for the future retirement security of the country.

In addition, the extension the RM3,000 yearly tax relief for the scheme until the 2025 announced during Budget 2021 demonstrates continued commitment by the Government and the SC to prioritise retirement well-being for all Malaysians. This move ensures that the rakyat remains incentivized to save for retirement in line with the well-established practice in multiple jurisdictions which provides tax relief for voluntary retirement savings.