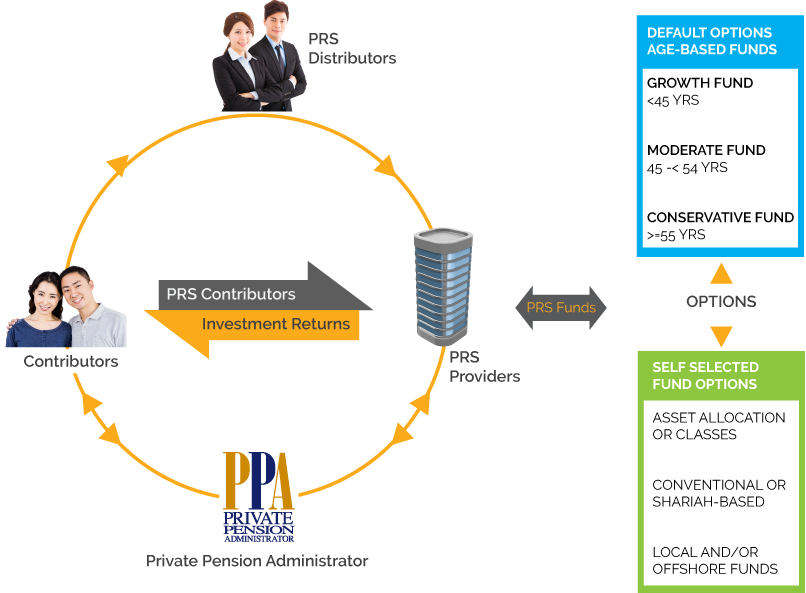

Structure of PRS

How PRS Works

To start your PRS savings, you may choose to make contributions directly to the PRS Provider or through their registered distributors. Once you have successfully started your PRS savings you are automatically given a PRS account.

PPA, as the central administrator for PRS will be administering your PRS account and will provide you an annual consolidated statement of your PRS account with the PRS Provider(s).

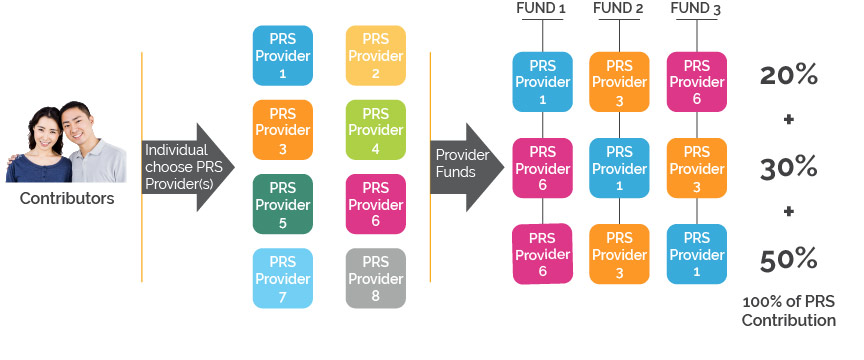

PRS Provider & Fund Options

You may choose to contribute to one (1) or more PRS Provider. Under each PRS Provider, you can further choose to invest into one (1) or more funds by either contributing based on the default option (age-based selection) or select a fund based on your preferred choice.

Default Option* for Core Funds (Age Based Selection)

One of the special features of the PRS is that it makes investing your savings for retirement easy with its default option of core funds. PRS default option for core funds offer a packaged mix of underlying asset classes that provides growth, moderate and conservative risk and returns based on evolving life stages towards retirement.

Each PRS Provider must offer three (3) core funds as a default option in their PRS. If you choose the default option you will be allocated to the following core funds based on your age grouping:

| Core Funds | Age | Principle |

|---|---|---|

| Growth Fund | Below 45 Years |

Focus is on growing the portfolio. Aim:

|

| Moderate Fund | 45 – 54 years old |

Focus is on growing the portfolio whilst seeking income. Aim:

|

| Conservative Fund | 55 years old and above |

Focus is on generating income consistent with getting the portfolio ready for utilisation. Aim:

|

When you select the default option, all contributions made by you, or by your employer on your behalf, will be allocated into the core fund which corresponds with your age group.

Default Option* for Core Funds: Auto Glide Path

Default option funds offer an automatic glide path in managing your funds towards retirement. The auto glide path is a unique feature of the default option funds where the PRS fund manager automatically switches your funds from a higher risk growth asset allocation to a more conservative lower risk asset allocation as capital preservation should take priority as you approach your retirement. This auto glide path makes it easy for you to manage your risk exposures over time based on a defined age grouping within each default option funds.

Switch-In Date

When you are on the auto glide path, your PRS Provider will notify you one month before your savings in PRS is slated to be switched into a moderate or conservative fund. The Switch-In Date is the day a PRS Member turns 45 or 55 years old.

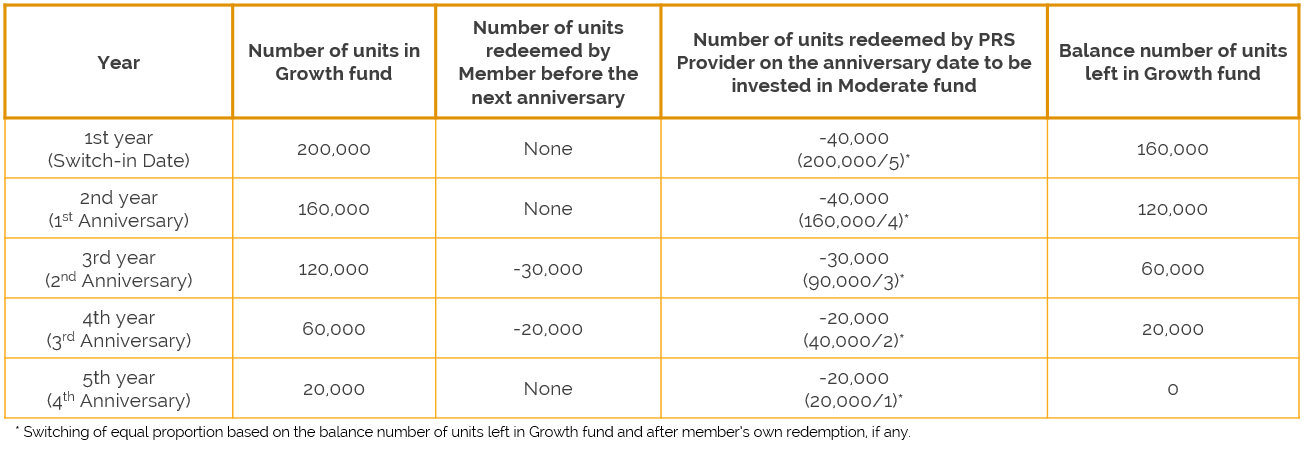

Unless you have instructed otherwise, the switching process will be executed by your PRS Provider over a five-year period, where each year an equal proportion of your total PRS balance, in units form, will be redeemed and used to purchase units in the next core fund.

Redemption of equal proportion over a five-year period is set out in the following scenario:

If a PRS Member currently has 200,000 units in a Growth fund under the default option, the scenario below illustrates the movement of units progressively from the Growth fund to a Moderate fund once the member attains the age of 45.

At the end of the five-year period, the member’s savings will be fully switched to the Moderate fund.

Default Option* : Principal Asset Management Berhad has embarked on different default option schemes, please refer here for more information

Note: The default option was updated by Securities Commission Malaysia on Feb 2020 and PRS Providers will implement these changes within one year. Please check with your respective PRS Providers for how this will affect your PRS account.

Alternatively, if you prefer to choose your own funds (self-selected option), you may choose any of the non-core PRS funds, which will require you to be actively involved in selecting funds based on your risk and return expectations. However, this will often require you to seek advice from a licensed PRS Consultant.

PRS and You