Your Retirement Should Be Your Reward

You work hard to provide for yourself and your family as well as to sustain your lifestyle. However, during the course of your career – while pursuing professional goals in addition to everything else – how often do you stop to think about life after work?

If you have not, you are not alone. According to reports, most Malaysians are not prepared for retirement. One possible explanation for this is that only 36% of Malaysians are financially literate, according to a World Bank study. Furthermore, because retirement is often perceived as a distant prospect, many people put off planning for it, assuming it can be taken care of at a later date or at a later part of their career.

Whether it is seeing the world with family, hiking with fellow outdoor enthusiasts or volunteering your time at a charitable organization, retirement should be a period when you finally get to enjoy everything you work for. And, when that time comes, your retirement savings will be expected to provide you with sufficient income to enjoy all the things that you temporarily set aside all those years ago.

This is How Much You Need to Save for Your Retirement

You probably have watched our latest video showing 10% to the tune of “ten, ten, ten, TEN” aka Beethoven’s Fifth Symphony. If not, you can view it here.

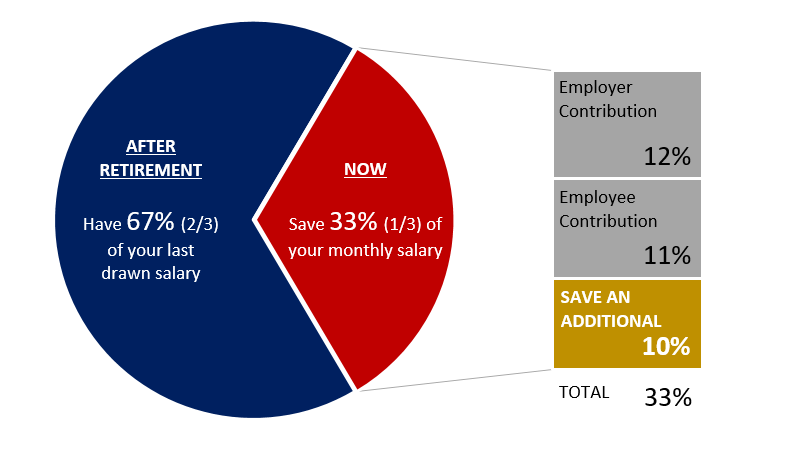

Studies and reports recommend having at least two-thirds (67%) of your last drawn salary as the amount needed to maintain your standard of living after retirement. To achieve the two-third benchmark, PPA suggests setting aside one-third (33%) of your monthly salary.

In Malaysia, if you are working in the private sector, you are most likely already contributing 11% of your salary to a mandatory scheme, which comes with a minimum employer contribution of 12%. Thus, for most of us, our mandatory contributions add up to 23%.

Hence, you just need to save an additional 10% of your income every month in the Private Retirement Schemes (PRS), a voluntary long-term saving and investment scheme designed to help you save more for your retirement. When you save 10% or more of your salary, you are paying yourself forward for your retirement.

Ten Percent

The amount each person needs for retirement may vary depending on the individual’s lifestyle. You can use PPA’s retirement calculator as a guide to find out how much you need to save for your retirement.

After working hard for three to four decades, your retirement should be your reward.

Get to enjoy everything you work for. Save in PRS.

PRS and You